Save money the Right Way. Don't miss. Read now!

There can be many events in life that could possibly alter the natural flow of an individual’s finances. This could be a result of natural calamities (earthquake, pandemics, floods, etc.) or through personal situations like failed business plans or loss of a job. These situations can give rise to financial constraints that could sometimes make it difficult to meet immediate needs. This is where the need for regular savings emerge. Savings can help to mitigate the financial constraints that an individual may face.

What is even better is that if you are fortunate enough to not witness any events, then you can invest the saved amount in assets like buying properties or vehicles or even plan a vacation.

Why should you develop a habit to save?

Sometimes dwindling business, staff lay-offs, a shrinking economic outlook and other similar factors can make it hard for one to survive. One may even have to pass months without any income. Creating a surplus through regular savings will help in a great way to keep you going during the emergencies. Besides, it can also help you to upgrade your lifestyle without putting a strain on your monthly finances.

The secret is to start now. This way you could be better equipped to deal with any situation that could have severe economic implications. Saving is a win-win situation for everyone. If you have saved a certain portion of your income for, say, 15 years and were lucky enough to never face a situation that demanded you to draw money out of your savings, you could use the fund to do something constructive. For example, you could buy a property and let it out on rent. This would further provide you with a monthly inflow of cash.

Sounds interesting? Let’s see how you can do it!

How much should you save?

This is an important question that crosses everyone’s mind. Most financial consultants say that individuals should aim at creating emergency savings that will help to meet 6 months of necessary expenses on the lower side and 1 year on the upper. If you are able to save more, it’s better.

Depending upon your long term goals, the right savings mix could vary. The important aspect is to save because, in the absence of a consistent flow of income during unprecedented situations, it will be these savings that will help you to live through the challenging times.

Best Practices to Build-up Savings

Here we present you some easy to follow savings practices that could come of great help. These will give diverse returns and help you achieve your long-term financial goals. Besides, it will also aid in letting you have adequate surplus cash to meet your short-term financial needs.

Have a Diverse Investment Portfolio

In India, we have a habit of directing our surplus cash to stock markets and buying precious metals like gold, silver, etc. While this is good to yield high returns in the long run, in times of emergencies it could be of less value. When the economic outlook falls, the markets also fall. This could wipe away your entire profits. The wise thing is to also have some amounts invested in highly liquid financial instruments like bank deposits, RDs, short-term government treasury bills, etc. These are short term investments and offer variable lock-in periods. You should reinvest them after they mature to keep growing the savings.

You can also save money on Mobile Payment Banks and Wallets like PayTM. These provide digital options to hold money and also offer interest on your deposits. The interest could be as high as 4% p.a. Two major benefits of using them are that they offer contactless payment options and are widely used by even smaller merchants around the country. The contactless payment option is something which is really needed in the world now.

Along with this also dedicate a part of your savings to SIPs, stock markets and commodities. These instruments may not give high returns initially but over the years, they could considerably appreciate your investment amounts.

Automate/Fix Your Monthly Savings

Whether you are going for a Fixed Deposit (FD), Recurring Deposits (RD), or any other investment opportunity, it is important to automate these savings. The reason is simple, it will help to create a financial disciple. When you know that you have to save a fixed amount every month, you would make judicial decisions when it comes to making expenses. You would cut down on your overhead expenses (entertainment and leisure) to ensure you meet your monthly savings requirements.

Check your non-essential expenses

Many times discounts and offers make us spend a little more than usual. Though there seems to be an advantage based on discounts we receive but the reality is the opposite. Most of these are actually not necessary. For example, buying 4 trousers for an offer when you just require two. Developing a habit to restrain ourselves from making such purchases could help to save more. This is because every unit of money saved is equal to a unit earned.

Start Saving from Today

The biggest problem that people make is postponing their savings practices. You should not wait for a favourable situation to arise. But you should start right from today. You can start with something as low as 50, 100 or 500 rupees. More than the amount, it is important to start today. If you are still not convinced just save money in a piggy bank. You will definitely thank us later!

We all remember putting one rupee coins inside piggy banks during our childhood days. When we used to open it after a few months, we found so much cash in our hands. That is exactly what we have to do. Saving small consistently for a long time can help us to keep going during an unprecedented economic emergency.

Consider this example

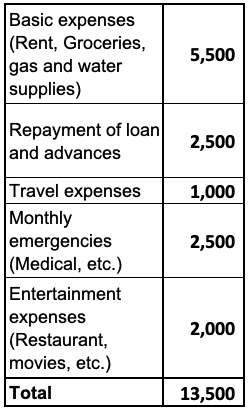

Mr Mehta realised during the 2008 economic recession how important it was to save for economic emergencies. Right when he started working in January 2009, he developed a habit of saving for a future emergency. At that time his salary was rupees 20,000 and monthly expenditure break-up as follows -

From the 6,500 he was left with, Mr Mehta started saving 1,500 every month for a future economic emergency. When the lockdown was announced this year, Mr Mehta was not worried about financial constraints during emergencies because he had already prepared for it. His monthly savings of 1,500 from 2008 had cumulated to 2,00,000 in 2020 (interest earned not included). This was enough to help him meet his basic expenses for an entire year. He realised that he had taken a great decision to save small but save regularly!

Everyone wants to live a life where they can fulfil their goals and for that, you definitely need some money at hand. Savings is what helps you to achieve it. If you plan your expenses well and save judiciously there are high chances that you would be able to use economic uncertainties to your advantage and turn them into an investment opportunity. There would certainly nothing be better than that!

Tag

- Money Savings